In the past two years, the technology industry has continued to increase its exploration of the "metaverse". As entry-level devices, AR/VR has attracted much attention, and the industry's heat has been transmitted from the terminal to various parts and components. At the same time, upstream material manufacturers have also benefited from it. As a type of high-end electronic-grade adhesive material, OCA optical adhesive is no exception.

Data shows that OCA optical adhesive has many advantages such as high clarity, high light transmittance, high adhesion, high weather resistance, water resistance, high temperature resistance, controlled thickness, and long service life. Therefore, terminal products with high requirements for optical imaging and display effects often have more demand for OCA optical adhesive.

Industry insiders pointed out: "At this stage, terminals are committed to reducing the discomfort of wearing head-mounted display devices for a long time, while enriching application scenarios, and imaging and display have always been an important direction of the industry chain. However, while improving the quality of imaging and display, it is also required not to increase the overall weight of the terminal equipment, so the use of some high-end functional materials has become one of the better solutions."

Domestic manufacturers actively occupy positions

In fact, OCA optical glue has long been used in consumer electronic products such as smartphones, but with the increasing demand in emerging markets such as vehicle-mounted displays, AR/VR, etc., several domestic listed companies such as Xinlun New Materials, Stdick, and Jinghua New Materials have gradually increased their investment in the field of OCA optical glue.

Jiwei.com consulted the information and found that Stdick has invested in a total of 6 new OCA production lines. As of now, 2 lines have reached trial production conditions, and the remaining production lines are expected to be installed and debugged this year. At present, the company has entered the rework and white-label markets, and has made breakthroughs in OCA products for foldable flexible displays.

In addition, the total amount of funds raised by Jinghua New Materials through non-public offering of shares in July this year (including issuance costs) does not exceed 436 million yuan. The planned investment projects include OCA-related production lines, and the main products after completion are OCA optical films. As for Selen Technology, the company's independently developed and produced folding OCA has been mass-produced and successfully applied to high-end folding screen mobile phones such as Xiaomi MIX Fold 2 and OPPO Find N.

A domestic glue agent told Jiwei.com: "At present, the supply of glue and tape used in some high-end electronic products is still dominated by large manufacturers, but as market demand expands, more and more manufacturers want to get a share of the pie. Including OCA, these glue materials have also begun to be developed by more domestic manufacturers in recent years. The question is whether you can highlight your competitiveness and make customers willing to adopt your products.

For a long time, the two major suppliers, Mitsubishi and 3M, have occupied most of the high-end OCA optical glue market. Whether in the new machine, white label or even the repair market, the two giants have a very high market share. In many aspects such as technology, capital, patents, and customers, high barriers have been established.

The manufacturer told Jiwei.com: "Relatively high-end electronic-grade glue materials such as OCA have relatively strict requirements on the environment, technical processes, and equipment, because the differences in these links will directly affect the physical and chemical properties of the raw materials, as well as the final product performance. And these production links need time and accumulation to achieve scale and maintain a high yield. ”

It is understood that it often takes 1-2 years for such adhesive material manufacturers to debug equipment and explore processes to develop a new product, and it takes half a year to a year for product sample certification. The certification cycle for core functional materials of first-tier terminal manufacturers even exceeds one year. Under the above premise, the rapid update and iteration of products in the consumer electronics industry has also made it more difficult for domestic manufacturers to gain a foothold in the market.

The above manufacturer added: "International manufacturers have been in the field of high-end electronic grade adhesive materials for a long time, so they have a lot of resources. On the contrary, the domestic start is relatively late. At present, domestic manufacturers are more involved in modules and processing links, because relatively speaking, the technical threshold of these links is not that high. ”

Since it starts from a relatively backward link, a problem that is in front of it also arises - changes in the upstream chemical raw material market can easily put it in a passive situation.

Short-term constraints on raw materials

In the past year or so, under the background of many macro-level factors, the prices of global bulk commodity raw materials have fluctuated violently, including the main raw materials of OCA optical adhesives. It is understood that the upstream raw materials of OCA optical adhesives mainly include: PET polyester film, PO polyolefin film and other substrates, acrylic pressure-sensitive adhesives, epoxy resins, etc., and the suppliers of adhesive film raw materials include 3M, Mitsubishi Chemical, Nitto Denko, etc.

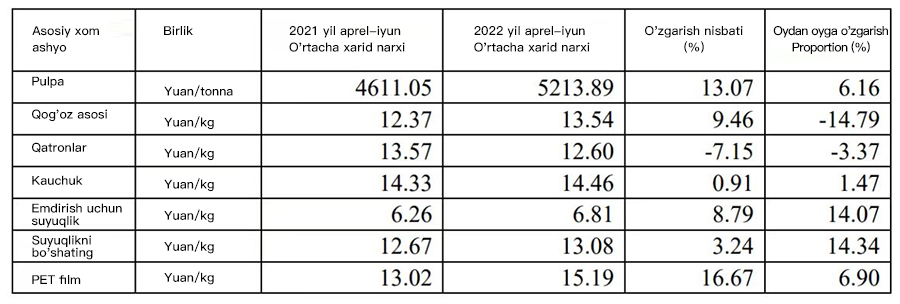

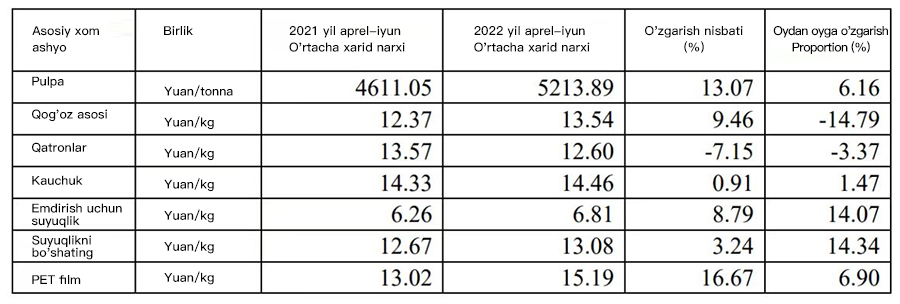

It is obvious that the upstream market of the OCA industry chain is still controlled by international manufacturers. The fewer competitors, the greater the profit margin of the product. According to a raw material price list recently disclosed by Jinghua New Materials, it can be seen that the above-mentioned manufacturers are still enjoying the lucrative profits brought by the price increase of raw materials at this stage.

Industry insiders mentioned at the beginning of this article pointed out: "In fact, most of the film material costs are relatively low after successful mass production, but the selling price and profit are very considerable. For example, a roll of electronic-grade tape produced by an international manufacturer is priced at 100 yuan, and the production cost may be less than 10 yuan. After the various costs such as factory operation are allocated, it is possible to achieve a profit of 40%-50%."

"It's just that the amount of profit depends on the competition in the subdivided industry. The more backward the link, the more intense the competition, and the more severe the price reduction. So now looking at some companies that only do processing, you can find that the product profit has been severely suppressed and basically no money is made."

In addition to the accumulation of production line links, equipment, technology, etc., the layout of talents and patents is also an important factor in these international manufacturers' ability to control the market voice for a long time.

“However, the research and development of material formulas requires not only professional knowledge, but also sufficient experience in the process and equipment. In the past, China basically poached some professional talents from overseas manufacturers, and cultivated relatively few of them. As the market and the scale of enterprises themselves gradually expand, they pay more and more attention to this aspect.”

In summary, the current OCA market size is still in the growth stage, which means that domestic manufacturers still have a lot of room for development. If they can seize the right time and track for layout, there is still a chance to see domestic manufacturers stand out in this field.